california renters credit turbotax

One account for everything Intuit including TurboTax. Eligibility is based on your 2020 tax return the one you file in 2021.

Turbotax Review 2022 Pros And Cons

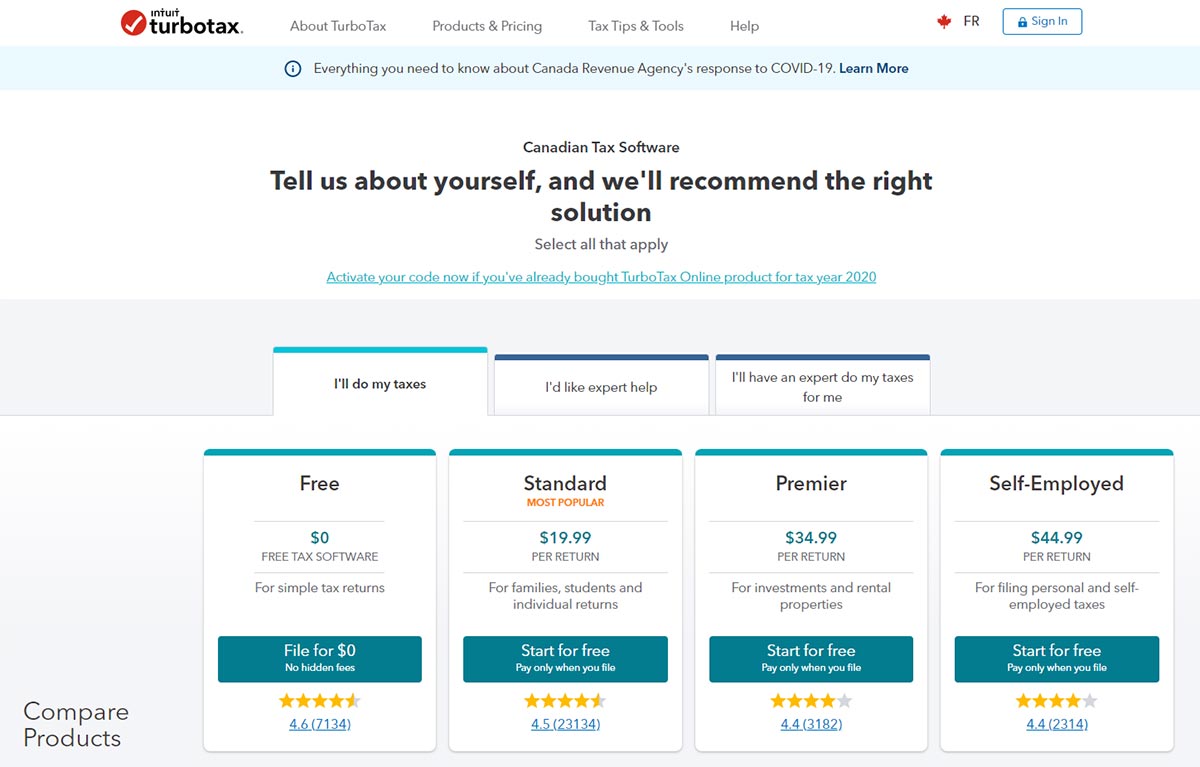

TurboTax Free makes it easy to apply for the Ontario Trillium Benefit with easy step-by-step directions.

. You will need to file your 2020 California state tax return by October 15 2021 in order to receive your California stimulus check. Theyd give a tax cut to low-. Today the renters credit is 60 for single filers and 120 for joint filers.

Province of Manitoba Personal Tax Credits. Only the renter or lessee can claim a credit on property that is rented or leased as a homestead. These renters tax credits help those who may struggle to obtain steady employment or who are unable to work and financially care for themselves due to age or disability.

Use Screen 53013 California Other Credits to enter information for the Renters credit. Several states also provide tax relief for renters who dont meet age or disability criteria. Depending upon the CA main form used the output will appear on Line 46 of the Form 540 or Line 19 of Form 540 2EZ.

The other eligibility requirements are as follows. These states have worked out their own formulas for awarding a renters tax credit to eligible tenants. Lacerte will determine the amount of credit based on the tax return information.

The credit is nonrefundable. To claim the renters credit for California all of the following criteria must be met. Residents of Manitoba who pay rent may be able to receive a credit of up to 20 of rent payments or 700 whichever is less.

You paid rent in California for at least 12 the year. 43533 or less if your filing status is single or marriedregistered domestic partner RDP filing separately. To claim the CA renters credit.

When the yearly tax credit was established decades ago in 1972 it was meant to help tenants manage. Some credits such as the earned income credit are refundable which means that you still receive the full amount of the credit even if the credit exceeds your entire tax bill. See How to Generate the California Renters Credit for.

You must be a California resident for the tax year youre claiming the renters credit. CRA Information for Residents of Manitoba. California allows a nonrefundable renters credit for certain individuals.

All of the following must apply. Your California income was. Simply put the California Renters Credit is a non-refundable credit worth sixty dollars or a hundred and twenty dollars if youre married filing jointly or a widowwidower that can be applied to your California income tax if youve lived in a rental property for more than half the year freeing up money that you might have to spend on renters insurance or other bills find out.

In California renters who make less than a certain amount currently 41641 for single filers and 83282 for married filers may be eligible for a. Login to your TurboTax account to start continue or amend a tax return get a copy of a past tax return or check the e-file and tax refund status. Some of Californias income tax credits include.

Renters earning less than 43533 a year are eligible for a 60 tax credit and renters earning less than 87066 a year who are married and file taxes jointly are eligible for 120. The property was not tax exempt. You paid rent for a minimum of six months for your principal residence.

Instead of property taxes can claim a credit based on 10 percent of the gross rent paid. Therefore if your total tax is 400 and claim a 1000 earned income credit you will receive a 600 refund. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident.

Click on Continue and answer Yes to the question Did any of these apply to you and you want to apply for the OEPTC. A bill proposed by state Sen. This is a 60 credit for single renters whose annual incomes fall below 43533 as of 2021.

Use the below guide to learn more. The maximum credit is 1200. In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively.

Go to Screen 53 Other Credits and select California Other Credits. To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. Millionaire taxes would increase 11 in 2023 under House Democrat plan.

To qualify for the CA renters credit. 87066 or less if you are marriedRDP filing jointly head of household or qualified. Phone number email or user ID.

For more information on Manitobas Education Property Tax Credit see the following links. House Democrats proposed tax reforms would raise levies for 1 million households by about 11 on average in 2023 according to the Joint Committee on Taxation. If you rent your home in California for at least six months of the year and make less than 43533 single filer or 87066 filing jointly you are eligible for the annual California renters credit.

California has signed the Golden State Stimulus which includes 600-1200 cash payments to eligible residents. This credit is calculated as part. Each state has its own regulations around a renters tax credit.

Check the box Qualified renter. That being said each state has its own unique set of rules and we get into these specifics below. It increases to 120 for marriedRDP taxpayers who file jointly and whose annual incomes fall below 87066.

Steve Glazer D-Orinda would increase those credits to 500 for single filers and 1000 for both joint filers and single filers with dependents. When using TurboTax Free click on the heading titled Provincial and click Get Started.

11 States That Give Renters A Tax Credit

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

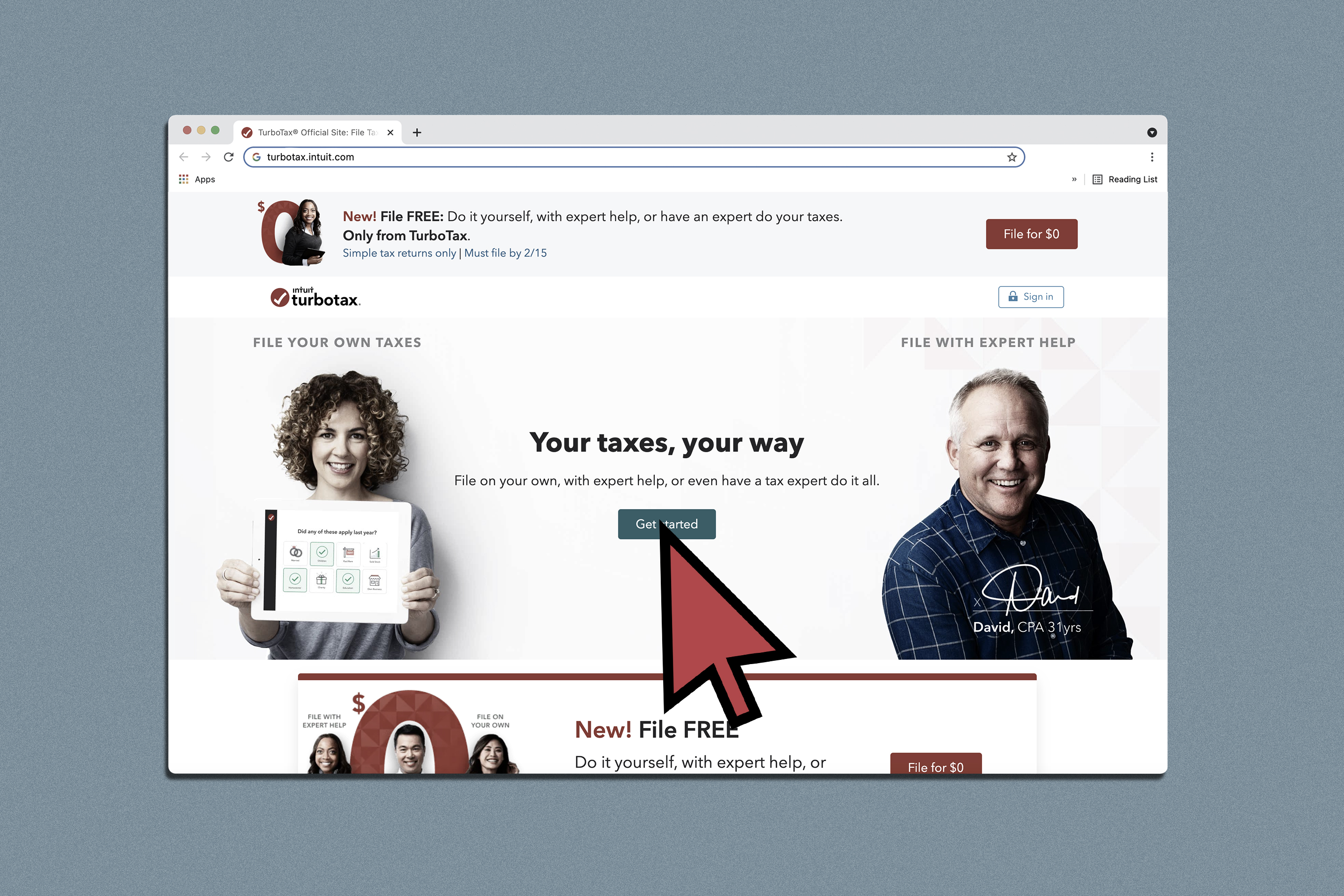

How To File Taxes For Free Turbotax 2022 Free File Change Money

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Credit Cards Offering Tax Service Saving Rewards In 2022 Nextadvisor With Time

Turbotax Maker Intuit To Pay 141m For Misleading Taxpayers Over Free Services Kron4

Turbotax A Review Best Tax Return Software In Canada Insurdinary

Quebec Property Owners Rl 31 Slips And The Solidarity Tax Credit

How To Claim The Education Property Tax Credit Eptc Loans Canada

What Is A Good Credit Score For Renting A Home

Intuit To Send Millions Of Turbotax Refunds After Settlement Money

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Turbotax Review 2022 Pros And Cons

How To File Taxes For Free In 2022 Money

Do I Have To Claim Income From Renting A Room In My Primary Residence If I M Not Making Any Money Comparative To Costs